The Resilient Drug Supply Project (RDSP) has built the world's largest database on pharmaceutical manufacturing, procurement, and distribution. Composed of more than 60 public and proprietary datasets, it can monitor the drug supply chain from start to finish and predict likely shortages of essential drugs affecting the United States.

Begun in 2018, this far-reaching project is one focus of the University of Minnesota's Center for Infectious Disease Research and Policy (CIDRAP), publisher of CIDRAP News.

The mission of the RDSP is to build and maintain a map of the global supply chain for each prescription drug used in the United States to reduce or avoid disruptions from any cause and for any reason. The Resilient Drug Supply Map will be a tool for stakeholders, policymakers, and consumers as they work to ensure that prescription drugs are available and accessible when patients need them. This purpose includes ensuring both public health and the national security.

RDSP's predictive models and algorithms are evidence-based and designed to evolve and adapt to changing situations, said RDSP Pharmaceutical Research Scientist David Margraf, PharmD, PhD. "The quantitative models we develop are validated by testing them for both past as well as new shortages," he added.

Supported by personal philanthropy of Christy Walton through the Walton Family Foundation, RDSP was launched to map drug supply chains and predict shortages using medication characteristics and other factors such as geographic concentration of contract manufacturers who make the active pharmaceutical ingredients (APIs) and finished-drug products.

So far, more than 25 people, including both professionals and students in pharmacy, public health, biostatistics, informatics, and epidemiology, have worked on aggregating and crunching the data.

"When prescription drugs are not affordable or accessible for any reason, consumers can experience lost work days, disease progression and complications, more visits to the emergency department, more hospitalizations, and even premature death," said Stephen Schondelmeyer, PharmD, PhD, who heads up RDSP with CIDRAP Director Michael Osterholm, PhD, MPH.

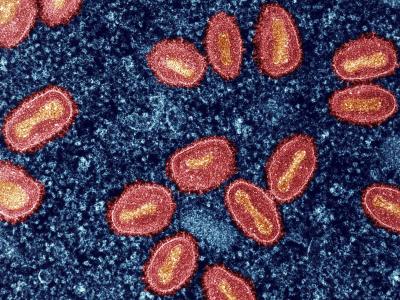

Osterholm said that the project's aims have expanded since its inception. "Our interest in this project was initially directed toward the inability to get appropriate and life-saving antibiotics to patients," because these essential drugs have been subject to shortages, he said.

"While all life-saving drugs are critical, we continue to focus on the challenge of antimicrobial resistance and to get the right drug for the bug."

Developing a market-wide view of supply chains

Most drug shortages, Schondelmeyer said, result from issues in the upstream supply chain, such as quality problems, recalls, shipping delays, raw material shortages, and geopolitical and economic issues, all of which the COVID-19 pandemic has thrust into the public eye.

"COVID not only saw increases in demand for certain drugs but it also exposed unexpected disruptions in the supply chain's production capacity," he said. "The pandemic and the secondary effects of shutting down factories and shipping pathways have had a large impact on drug supply chains."

By tracking and analyzing these issues in addition to other factors such as weather patterns, import and export routes, critical infrastructure, and geopolitical risks, Schondelmeyer said the RDSP team hopes to change the US drug supply chain to a system in which future shortages can be anticipated and mitigated and not just managed after the fact.

While there is some overlap of goals between the RDSP Map and the US Pharmacopeia's (USP's) generic-drug Medicine Supply Map (MSM) featured in part 1 of this series, the RDSP Map encompasses each unique brand-name, generic, biologic, biosimilar, and vaccine on the US market. The RDSP Map includes all 90,000 unique drugs on the market, 34.2% of them brand-name prescription products, and 65.8% generics.

The RDSP Map includes information from numerous US Food and Drug Administration (FDA) databases; however, the FDA's information on specific drug products is sometimes incomplete or disjointed, and the data in different files often cannot be easily combined or linked to other data sets because of inadequate identifiers. RDSP goes beyond FDA data to include other public and commercial datasets and more than 200 potential drug-shortage risk factors, including inert ingredients and packaging and drug-delivery components such as needles and inhalers.

The RDSP team collaborates with numerous other organizations such as USP; the FDA; the National Academies of Sciences, Engineering, and Medicine (NASEM); Angels for Change, CivicaRx; Phlow Pharmaceuticals; Medicines 4 All; Walmart; Amerisource Bergen; Biomedical Advanced Research and Development Authority (BARDA); the End Drug Shortages Alliance; Vizient; the New Zealand Medicines & Medical Devices Safety Authority; and many others.

"We rely on public FDA databases, and we have edited and validated and checked them against other sources to fix the gaps," Schondelmeyer said.

"We're also adding the number of defined daily doses produced at each facility to create a quantitative measure of drug supply. This will enable calculation of the percentage contribution or concentration of US drug consumption originating from a specific country. It's a much better measure than number of factories as an indicator of our nation's drug supply dependency on a given country."

Monitoring critical drugs

The RDSP team has already mapped the National Drug Codes (NDCs) for the 156 drugs it identified as critical for treating acute conditions and the 40 drugs considered to be critical for COVID-19 treatment. Critical drugs are those that, if unavailable, could result in severe illness or death within hours or days.

"It's not enough to have approved drugs for the treatment of acute conditions, unless they're available when they're needed, and that's why this project is so important," Osterholm said.

NDCs identify each drug product and its dose form, strength, package size, and manufacturer as well as the product labeling. RDSP tracks and updates shortages of these products each week on its website, based on data from the American Society of Health-System Pharmacists (ASHP) and the FDA. "We are mapping drugs from key starting materials manufacture down to the patient-level distribution," Margraf said.

Overall, Schondelmeyer said, mapping has shown that availability of the top-prescribed US generic and brand-name drug products depends heavily on foreign sources for both APIs and finished drug products.

RDSP's work has revealed, for example, that 90% of the top 30 brand-name drugs sold in the United States are made outside of the country and that only 10% of the their APIs are made in this country. Likewise, 90% of the top 30 generic drugs are made in foreign countries, or their country of origin is unreported. India, which depends on China for up to 70% of its key starting materials, is the primary source of generic drugs for the US market.

The roots of these shortages are often complex. For example, sodium chloride solution, or saline, an essential product used in hospitals to reconstitute or deliver drugs, hydrate patients, and flush intravenous lines, has been in shortage recently due to the Omicron variant surge and the war in Ukraine.

"Saline is one of the most ubiquitous products, yet we have shortages," Schondelmeyer said. These shortages, however, are not due to a lack of sodium chloride but rather to supply chain issues affecting products used to store and administer saline, such as heparin, needles, and vial stoppers, because some factories producing these products were repurposed during the pandemic to produce other small-volume, highly consequential drugs.

"Even if you have plenty of sodium chloride, it doesn't mean you have saline flushes," he said.

Although the detailed data found in the RDSP Map are not publicly available, the RDSP team has published reports, including a COVID-19 CIDRAP Viewpoint, "Ensuring a Resilient US Prescription Drug Supply," as well as given testimony to the US Senate on lessons from the pandemic and recommendations for moving forward. This summer, the team is developing a tool to provide geographic visualizations of the supply chain data for most drug products available through a website.

The goal of the RDSP Map is to recognize potential drug shortages and develop solutions to head them off. And although some RDSP data cannot be made public because it belongs to other entities, the RDSP team plans to release most of the nonproprietary data for use by stakeholders and other data scientists.

"We provide a great deal of value as a center focused on drug shortages with regard to the dissemination of knowledge and resources that benefit the public health and patient care," Margraf said.

This is part 2 of a 2-part series on tracking drug supply chain issues. The first story, on US Pharmacopeia's supply map, was published Mar 31.